Author: Laura

Why Christians Should Not Celebrate Halloween

Children and adults alive love celebrating Halloween but Halloween is seen as a no, no in the Christian community, and for a valid reason. When asked the reason why Christians don’t celebrate Halloween, many Christians will say because it is a pagan holiday because that is what they have been taught.

What does it all mean, pagan means one of a people or community observing a polytheistic religion, pertaining to, characterized by, or adhering to the doctrine that there is more than one god or many gods, paganism is a form of idolatry because it is the worship of something or things other than the true and living God.

Origins of Halloween

“The earliest trace (of Halloween) is the Celtic festival, Samhain, which was the Celtic New Year. It was the day of the dead, and they believed the souls of the deceased would be available.

The Symbols of Halloween

Halloween originated as a celebration connected with evil spirits. Witches flying on broomsticks with black cats, ghosts, goblins, and skeletons have all evolved as symbols of Halloween. They are popular trick-or-treat costumes and decorations for greeting cards and windows.

Now, I know you are thinking, the same thing many Christians will respond with, we don’t celebrate it like that today, it is all in fun for the kids! But fun is not the words that come to mind when you look not only at the Origins of Halloween, but the influence of Halloween.

Halloween Today

Black is one of the traditional Halloween colors, probably because Halloween festivals and traditions took place at night. In the weeks before October 31, Americans decorate windows of houses and schools with silhouettes of witches and black cats.

Influences of Halloween

Due to American social influences, the rise of satanic cults, and Hollywood’s sinister characters possessed with evil, Americans have become fascinated with gore and death. All of this has manifested itself into many destructive Halloween trends. In the 1960s, pre-Halloween pranks turned into vandalism in some parts of the United States, with some people breaking windows and destroying property. In the 1970s, nationwide reports of candy being loaded with pins and razor blades permeated the airwaves. During the 80s and 90s, Halloween vandalism escalated to include arson, or the deliberate setting of fires, which destroyed private property and businesses.

As you can see Halloween brings real meaning to the scripture in Ephesians 6:12 which says – For we wrestle not against flesh and blood, but against principalities, against powers, against the rulers of the darkness of this world, against spiritual wickedness in high places. Why would a Christian want to take part in this type of event? As a Christian, to take part in this celebration goes against the teaching of the bible and does not bring glory to the one we serve.

What Can We do About It?

We don’t have to take away the fun for the kids who look forward to the day, the church has been called to turn the dark things of this world into the light, for our father who is in heaven is light and his presence and purpose should be clearly evident on that day, the day the dark things in this world is being glorified.

2 Corinthians 10:4-5 says For the weapons of our warfare are not carnal, but mighty through God to the pulling down of strongholds, casting down imaginations, and every high thing that exalteth itself against the knowledge of God, and bringing into captivity every thought to the obedience of Christ; the battle is not ours but the Lord’s and we are his servants ordained to carry out his work, whenever there is darkness you turn on the light.

Let every church arise and fight, pick up the weapons our warfare, host positive Christian based youth/ children events on that day, support Christian events held at your church, or in your local community.

Article Complied and Edited By Lenora Lee

10 Types of Accounts for Small Businesses:

Accounting is the process used to identify, record, and communicate finances and financial activities in businesses and organizations. Accounting is often referred to as the “language of business”. Accounting records and tracks financial transactions and business events showing what a business owns and what it owes others.

1. Cash Account

All your business transactions pass through the Cash account, often bookkeepers will use two journals, Cash Receipts, and Cash Disbursements, to track the activity.

2. Accounts Receivable

If your company sells products or services and doesn’t collect payment immediately, you have “receivables,” or money due from customers. It is important that you track Accounts Receivable and keep them up to date and send timely and accurate bills or invoices.

3. Inventory

Unsold products must be carefully accounted for and tracked. The numbers in your books should be periodically tested by doing physical counts of the inventory on hand.

4. Accounts Payable

accounts payable records what the business owes to others such as vendors. Good record keeping will help you to keep track of money going out to pay timely payments and avoid paying someone twice! And possibly save you money since some businesses will offer a discount on timely payments,

5. Loans Payable

If you’ve borrowed money to buy equipment, vehicles, furniture, or other items for your business, this account tracks payments and due dates.

6. Sales

The Sales account tracks all incoming revenue from what you sell. Recording sales in a timely and accurate manner is critical to knowing where your business stands at a given point in your business.

7. Purchases

The Purchasing Account tracks any raw materials or finished goods that you buy for your business. This account is used in calculating the “Cost of Goods Sold” (COGS), which is subtracted from Sales to determine your company’s gross profit.

8. Payroll Expenses

Payroll expense is the number of salaries and wages paid to employees in exchange for services rendered by them to a business. The term may also be assumed to include the cost of all related payroll taxes, such as the employer’s matching payments for Medicare and social security. Keeping this account accurate and up to date is essential for meeting tax and other government reporting requirements.

9. Owner’s Equity

Owner equity tracks the amount an owner (or owners) puts into the business. Also referred to as net assets, owner equity reflects the amount of money an owner has once liabilities are subtracted from assets.

10. Retained Earnings

The Retained Earnings account tracks any company profits that are reinvested in the business and are not paid out to the owners. Retained earnings are cumulative, which means they appear as a running total of money that has been retained since the company started. This account is very important to investors and lenders who want to track how the company has performed over time.

The Five Basic Types of Accounts in Accounting:

- Assets, what the business owns

- Liabilities, what the business owes

- Revenues or income, money earned by the business, usually through sales

- Expenses necessary to run the business

- Equity is liabilities, subtracted from assets = the business’s net worth

Basic Accounting Equation

Accounting is more about learning concepts and methods than about adding and subtracting numbers. If you understand the basics you’ll be well on your way to understanding accounting. There are a few basic accounting terms that are important to understand.

The first term is an account

An account is a record in the accounting system used to collect and store business transactions.

Examples of accounts an organization may use are

……Sales,…

…Equipment,…

…Office Supplies,…

…Utilities,…

Think of an account as a way to store information. For example, if you had a large container of fruits, oranges, apples, and peaches to sort, each type of fruit would be sorted into a different carton that would represent its own account.

You would have one account for each type of fruit. After you had emptied the large container of fruits by sorting each fruit into its carton, or account, you could then total the amounts in each account. Then, you would know how many oranges,

apples, and peaches, are in each account and could easily determine the cumulative amount of all accounts.

The Second Term is Transactions

Another important term is “transaction”. Transactions are events that affect an organization financially or cause some kind of financial change. Examples of transactions that an organization might record in its accounting system are the purchase of office supplies such as paper, or a payment to the utility company for the prior month’s electric bill.

The Basic Accounting Equation is

…...Assets……equal Liabilities……plus Equity.

This equation represents the relationship between these three categories. This basic equation guides organizations when recording and reporting their financial transactions. If you are new to accounting it is important to memorize this fundamental concept.

Assets, liabilities, and equity

Assets, liabilities, and equity are 3 accounting terms used to identify what an organization owns and what it owes others.

Assets are an organization’s resources or what it owns. (e.g., accounts receivable, inventory)

Liabilities are claims on the organization or what it owes others. (e.g., accounts payable, loans)

Equity or capital, which is also referred to as net assets. Equity is what remains after all liabilities or debts of the organization are paid. If you take the organization’s total assets and subtract its total liabilities you would then know how much equity remains.

This basic equation provides a way to measure a company’s profitability or lack of profitability. It also states assets must always equal liabilities plus equity. In accounting, this equation should always be followed and the rules of the equation should never be broken.

Free Applications you can Use to Build Websites

The internet is filled with free applications you can use to build a professional website. WordPress by far is the choice of newbies and seasoned developers as well. But, there are many other free applications that have been around for a long time and some new arrivals that developers use to set up dynamic websites on the Internet.

The Nutrient Benefits of Whole Grains

Brief Overview: Whole grains are apart of the Plant-based diet, Whole Grains Were Often Eaten in Times of Hardship, The Book of Ezekiel is one of the most detailed and well-known references to grains, as God commands Ezekiel to use “wheat and barley, and beans and lentils, and millet and spelt” to make bread for the people to eat. Ezekiel 4: 9

Eating grains, especially whole grains provides health benefits. People who eat whole grains as part of a healthy diet have a reduced risk of some chronic diseases. Grains provide many nutrients that are vital for the health and maintenance of our bodies.

Whole grains include grains like wheat, corn, rice, oats, barley, quinoa, sorghum, spelt, rye – when these foods are eaten in their “whole” form Whole grains even include popcorn!

Health experts advise everyone – men and women, young and old – that grains are a healthy necessity in every diet, and that it’s important to eat at least half our grains as “whole grains.”

What is a Whole Grain

All grains start life as whole grains. In their natural state growing in the fields, whole grains are the entire seed of a plant. This seed (which industry calls a “kernel”) is made up of three key edible parts – the bran, the germ, and the endosperm – protected by an inedible husk that protects the kernel from assaults by sunlight, pests, water, and disease.

THE BRAN

The bran is the multi-layered outer skin of the edible kernel. It contains important antioxidants, B vitamins and fiber.

THE GERM

The germ is the embryo which has the potential to sprout into a new plant. It contains many B vitamins, some protein, minerals, and healthy fats.

THE ENDOSPERM

The endosperm is the germ’s food supply, which provides essential energy to the young plant so it can send roots down for water and nutrients, and send sprouts up for sunlight’s photosynthesizing power. The endosperm is by far the largest portion of the kernel. It contains starchy carbohydrates, proteins, and small amounts of vitamins and minerals.

WHOLE GRAINS ARE HEALTHIER because whole grains contain all three parts of the kernel. Refining normally removes the bran and the germ, leaving only the endosperm. Without the bran and germ, about 25% of a grain’s protein is lost, and are greatly reduced in at least seventeen key nutrients. Processors add back some vitamins and minerals to enrich refined grains, so refined products still contribute valuable nutrients. But whole grains are healthier, providing more protein, more fiber and many important vitamins and minerals.

Nutrients

- Grains are important sources of many nutrients, including complex carbohydrates, dietary fiber, several B vitamins (thiamin, riboflavin, niacin, and folate), and minerals (iron, magnesium, and selenium).

- Dietary fiber from whole grains or other foods may help reduce blood cholesterol levels and may lower the risk of heart disease, obesity, and type 2 diabetes. Fiber is important for proper bowel function. It helps reduce constipation and diverticulosis. Fiber-containing foods such as whole grains help provide a feeling of fullness with fewer calories.

- The B vitamins thiamin, riboflavin, and niacin play a key role in metabolism – they help the body release energy from protein, fat, and carbohydrates. B vitamins are also essential for a healthy nervous system. Many refined grains are enriched with these B vitamins.

- Folate (folic acid), another B vitamin, helps the body form red blood cells. Women of childbearing age who may become pregnant should consume adequate folate from foods and in addition 400 mcg of synthetic folic acid from fortified foods or supplements. This reduces the risk of neural tube defects, spina bifida, and anencephaly during fetal development.

- Iron is used to carry oxygen in the blood. Many teenage girls and women in their childbearing years have iron-deficiency anemia. They should eat foods high in heme-iron (meats) or eat other iron-containing foods along with foods rich in vitamin C, which can improve the absorption of non-heme iron. Whole and enriched refined grain products are major sources of non-heme iron in American diets.

- Whole grains are sources of magnesium and selenium. Magnesium is a mineral used in building bones and releasing energy from muscles. Selenium protects cells from oxidation. It is also important for a healthy immune system.

Health benefits

- Consuming whole grains as part of a healthy diet may reduce the risk of heart disease.

- Consuming whole-grain foods that contain fiber, as part of an overall healthy diet, can support healthy digestion.

- Eating whole grains, as part of an overall healthy diet, may help with weight management.

- Eating grain products fortified with folate helps prevent neural tube defects when consumed as part of an overall healthy diet before and during pregnancy.

Whole grains may be eaten whole, cracked, split, or ground. They can be milled into flour or used to make bread, cereals, and other processed foods. If a food label states that the package contains whole grain, the “whole grain” part of the food inside the package is required to have the same proportions of bran, germ, and endosperm as the harvested kernel does before it is processed.

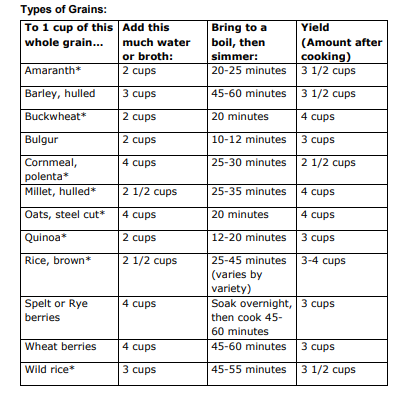

How to Cook Whole Grains

Cooking Whole Grains

Compared to refined or “white” grains, whole grains are usually chewier and have a nuttier, fuller flavor. You may find this unfamiliar at first but stick with it until your palate adjusts and then reap the health benefits. The thing about whole grains besides getting used to the taste, it is not always easy to cook them it takes practice to master the skill of cooking them to perfect perfection!

Standard Method

- Put the dry, uncooked grain in a pan with the appropriate amount of cool water or broth.

- Place over high heat and bring it to a boil

- Reduce heat to low. Cover and simmer until the liquid is absorbed.

Pilaf Method

- Brown small bits of onion, mushroom, and garlic with a little oil in a saucepan.

- Add the dry grain and cook until fragrant, about 1-3 minutes.

- Add the appropriate amount of low-sodium broth.

- Place over high heat and bring it to a boil

- Reduce heat to low. Cover and simmer until the liquid is absorbed.

Time Varies when Cooking Grains

Grains can vary in the time they take to cook. When they are tender, they are done! If the grain is not as tender as you like when “time is up,” simply add more water and continue cooking. On the other hand,if everything seems fine before all the liquid is absorbed, simply drain the excess liquid.

Whole Grain Cooking Shortcuts

Let grains sit in the specified amount of water for a few hours. After soaking, add extra water if necessary, then cook (time will be shorter).

• Cook whole grains in big batches. They will keep for 3-5 days in your fridge and take just minutes to warm up. Add a little water or broth if needed. You can also use the leftovers for salads, grain bowls, or soup.

Fixing Sticky Bottoms

If the whole grains are sticking to the bottom of your pan, turn off the heat, add a very small amount of liquid, put a lid on the pan, and let it sit a few minutes. The grain will loosen, for easier serving and cleanup.

Government-funded benefit and assistance programs you may be entitled to

Government and nonprofit Charity organizations assistance programs are designed to assist individuals and families in a variety of situations. Learn what type of assistance/benefits you may be entitled to.

Benefits.gov

Benefits.gov helps citizens determine their potential eligibility for more than 1,000 government-funded benefit and assistance programs. Benefits.gov uses a questionnaire that can take from 20 minutes or so to complete. The questionnaire will help you find the right benefits for you. At the end of the questionnaire, you will receive a detailed report with a list of government programs you may be eligible for and a link to detailed information about the program. The results can be printed out for later review.

211

2-1-1 is a nationwide service connecting millions of people to help every year. 2-1-1 is a special abbreviated telephone number reserved in the United States and Canada as an easy-to-remember three-digit telephone number meant to provide information and referrals to health, human and social service organizations. To use the 211 Nationwide Assistance Program, select your state to find information on just about any type of need you may have including housing for seniors and people with disabilities.

Applying For A Business Loan? 5 Facts You Should Know About Your Credit Report

Good credit is essential to getting a business loan, bad credit comes back to haunt you when you need good credit to apply for a loan and the creditor says no way! Even if you have a negative credit report there are some things you can do to make it better when you know the facts.

Fact 1

The first step is to get a copy of your credit report. Under the law, everyone is entitled to a free annual report, and in certain situations, you are also entitled to a free report under federal law. You’re entitled to a free report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you ask for your report within 60 days of receiving notice of the action.

The notice will give you the name, address, and phone number of the credit reporting company. You’re also entitled to one free report a year if you’re unemployed and plan to look for a job within 60 days; if you’re on welfare; or if your report is inaccurate because of fraud, including identity theft. Otherwise, a credit reporting company may charge you a reasonable amount for another copy of your report within a 12-month period. You can get immediate access to your credit report, there are many different places on the net offering a free credit report, but according to the federal trade commission, only one is approved by the FTC!

Fact 2

The credit agency must correct inaccuracies or incomplete information — in your credit report

Under the FCRA, both the credit reporting company and the information provider (that is, the person, company, or organization that provides information about you to a consumer reporting company) are responsible for correcting inaccurate or incomplete information in your report. To take full advantage of your rights under this law, contact the credit reporting company and the information provider.

1. Tell the credit reporting company, in writing, what information you think is inaccurate.

Credit reporting companies must investigate the items in question — usually within 30 days — unless they consider your dispute frivolous. They also must forward all the relevant data you provide about the inaccuracy to the organization that provided the information. After the information provider receives notice of a dispute from the credit reporting company, it must investigate, review the relevant information, and report the results back to the credit reporting company. If the information provider finds the disputed information is inaccurate, it must notify all three nationwide credit reporting companies so they can correct the information in your file.

When the investigation is complete, the credit reporting company must give you the written results and a free copy of your report if the dispute results in a change. (This free report does not count as your annual free report.) If an item is changed or deleted, the credit reporting company cannot put the disputed information back in your file unless the information provider verifies that it is accurate and complete. The credit reporting company also must send you written notice that includes the name, address, and phone number of the information provider.

2. Tell the creditor or other information provider in writing that you dispute an item. Many providers specify an address for disputes. If the provider reports the item to a credit reporting company, it must include a notice of your dispute. And if you are correct — that is, if the information is found to be inaccurate — the information provider may not report it again.

Fact 3

A credit reporting company can report most accurate negative information for seven years and bankruptcy information for 10 years.

There is no time limit on reporting information about criminal convictions; information reported in response to your application for a job that pays more than $75,000 a year, and information reported because you’ve applied for more than $150,000 worth of credit or life insurance. Information about a lawsuit or an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

Fact 4

Creditors, insurers, employers, and other businesses that use the information in your report to evaluate your applications for credit, insurance, employment, or renting a home are among those that have a legal right to access your report.

Fact 5

Your employer can get a copy of your credit report only if you agree. A credit reporting company may not provide information about you to your employer, or to a prospective employer, without your written consent.

Don’t be fooled by websites that offer free credit reports only one is approved by the FTC!

Your credit report has information that affects whether you can get a loan — and how much you will have to pay to borrow money. It is situations like this you will want a copy of your credit report to:

- make sure the information is accurate, complete, and up-to-date before you apply for a loan for a major purchase like a house or car, buy insurance, or apply for a job.

- help guard against identity theft. That’s when someone uses your personal information — like your name, your Social Security number, or your credit card number — to commit fraud. Identity thieves may use your information to open a new credit card account in your name. Then, when they don’t pay the bills, the delinquent account is reported on your credit report. Inaccurate information like that could affect your ability to get credit, insurance, or even a job.

Your Free Credit Report

Only one website is authorized to fill orders for the free annual credit report you are entitled to under law! Other websites that claim to offer “free credit reports,” “free credit scores,” or “free credit monitoring” are not part of the legally mandated free annual credit report program. In some cases, the “free” product comes with strings attached. For example, some sites sign you up for a supposedly “free” service that converts to one you have to pay for after a trial period. If you don’t cancel during the trial period, you may be unwittingly agreeing to let the company start charging fees to your credit card.

Some “imposter” sites use terms like “free report” in their names; others have URLs that purposely misspell annualcreditreport.com in the hope that you will mistype the name of the official site. Some of these “imposter” sites direct you to other sites that try to sell you something or collect your personal information.

How To Avoid a Scam:

Annualcreditreport.com is the only website authorized to fill orders for the free annual credit report you are entitled to under law!

As a nationwide credit reporting company, they will not send you an email asking for your personal information. If you get an email, see a pop-up ad, or get a phone call from someone claiming to be from annualcreditreport.com or any of the three nationwide credit reporting companies, do not reply or click on any link in the message. It’s probably a scam.

The Fair Credit Reporting Act (FCRA) requires each of the nationwide credit reporting companies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months. The FCRA promotes the accuracy and privacy of information in the files of the nation’s credit reporting companies. The Federal Trade Commission (FTC), the nation’s consumer protection agency, enforces the FCRA with respect to credit reporting companies.

A credit report includes information on where you live, how you pay your bills, and whether you’ve been sued or have filed for bankruptcy. Nationwide credit reporting companies sell the information in your report to creditors, insurers, employers, and other businesses that use it to evaluate your applications for credit, insurance, employment, or renting a home.

How To Get Your Free Credit Report:

The three nationwide credit reporting companies have set up a central website, a toll-free telephone number, and a mailing address through which you can order your free annual report.

To order, visit annualcreditreport.com, call 1-877-322-8228. Or complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281. Do not contact the three nationwide credit reporting companies individually. They are providing free annual credit reports only through annualcreditreport.com, 1-877-322-8228 or mailing to Annual Credit Report Request Service.

In the past, you could order your reports from each of the three nationwide credit reporting companies at the same time, or you could order your report from each of the companies one at a time. The law allowed you to order one free copy of your report from each of the nationwide credit reporting companies every 12 months.

As of 2020, everyone in the U.S. can get 6 free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. That’s in addition to the one free Equifax report (plus your Experian and TransUnion reports) you can get at AnnualCreditReport.com.

The Type Of Information You Will Need To Provide:

You need to provide your name, address, Social Security number, and date of birth. If you have moved in the last two years, you may have to provide your previous address. To maintain the security of your file, each nationwide credit reporting company may ask you for some information that only you would know, like the amount of your monthly mortgage payment. Each company may ask you for different information because the information each has in your file may come from different sources

How Soon Will I Get a Free Report ?

If you request your report online at annualcreditreport.com, you should be able to access it immediately. If you order your report by calling toll-free 1-877-322-8228, your report will be processed and mailed to you within 15 days. If you order your report by mail using the Annual Credit Report Request Form, your request will be processed and mailed to you within 15 days of receipt.

Whether you order your report online, by phone, or by mail, it may take longer to receive your report if the nationwide credit reporting company needs more information to verify your identity.