Small Business Bookkeeping is every aspiring entrepreneur’s sole responsibility! But, it doesn’t have to be a burden, with the right tools you can do it! It doesn’t matter if you are making money in self-employment full or part-time. It doesn’t matter if your business is a sole proprietorship, partnership, or corporation, the success of your business depends on creating and maintaining an effective record-keeping system.

For tax purposes, you are required to keep good accounting records suited to your particular business needs. What it all boils down to, is proper record-keeping for small businesses makes the process easier and keeps you compliant with the law. Good record-keeping is also about understanding your business, now and in the future.

Good records can also show whether your business is improving, which items are selling, or what changes you need to make to increase the likelihood of business success. You don’t need a license, degree, or experience to do your own bookkeeping.

Difference Between An Account And A Bookkeeper

Bookkeeping is the first part of the accounting process, so the work of a bookkeeper and accountant often overlaps. The difference between an Accountant and a Bookkeeper is an accountant is a professional who handles the bookkeeping and prepares financial documents like profit-and-loss statements, balance sheets, etc. They perform audits of your books, prepare reports for tax purposes, and handle all the financial information that’s part of running your business.

Bookkeeping focuses on recording and organizing financial data, while accounting is the interpretation and presentation of that data. With the use of computerized accounting systems, small business owners can do most of the work themselves and produce their own financial documents.

Your record-keeping system should include:

1. Detail Tracking

You are required to track a significant amount of information, such as customers, sales, inventory, and expenses. Without a proper record-keeping system, tracking important details of your business may be impossible and can lead to you paying far more taxes than you should have.

2. Legal Compliance

As an employer, you are required to maintain and report employee payroll for tax purposes.

3. Tax Preparation (Federal, State, and Local)

You need good records of your financial transactions to prepare your tax returns. Your records must support the income, expenses, and any credits you report. Which may be able to save you thousands of dollars.

Supporting documents you will need sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks. Purchases, sales, payroll, and other transactions you have in your business will generate supporting documents.

Generally, these are the same records you use to monitor your business and prepare your financial statements.

The financial statement may include income (profit and loss) statements and balance sheets.

–An income statement shows the income and expenses of the business for a given period of time.

–A balance sheet shows the assets, liabilities, and equity in the business on a given date.

Manual Bookkeeping Vs Computerized Bookkeeping

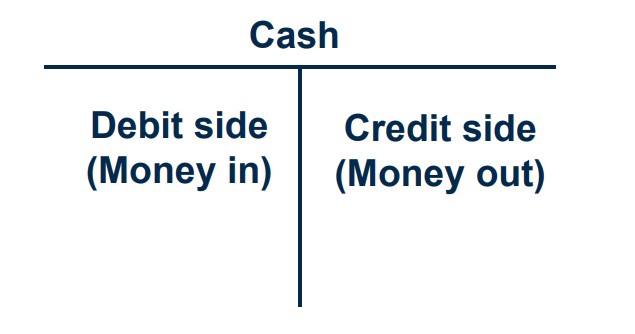

With manual bookkeeping business accounting records are entered into a notebook or journal. You should have a little basic understanding of the types of small business accounts and then there are the Debits and Credits which are a part of The Accounting Equation. Transactions are entered using debits and credits, debits and credits can be the most confusing part of bookkeeping for beginners. You will also have to decide what accounting method you will use to enter your transactions.

Computerized Bookkeeping

Computer accounting software is ideal for handling your small business bookkeeping quickly and easily. If you are starting your first business, you will quickly find out how important accounting software is to the success of the business. You don’t have to worry about having extensive knowledge of accounting, because computers transfer the right numbers to the right accounts and make sure those numbers get put on the proper side of the account, the debit or the credit side.

QuickBooks is the industry standard but some small businesses may find it costly when just starting out in business. GnuCash is a free open-source small business accounting software that may not have all the bells and whistles like QuickBooks, but it gets the job done and best of all it’s free.