Unclaimed money is not a scam or promotional gimmick! Unclaimed money could actually be owed to you for a variety of reasons. Before you say oh no, not me! I have spoken to many people about unclaimed money and some have actually found their names on the list, including some of my close relatives and friends. Before I told them about it they were unaware of the different types of unclaimed money lists there are.

Long before the Internet, unclaimed property lists were published in the local newspapers. If you were lucky enough to find your name on the list among the many other unclaimed property owners. In those days you would simply contact the Government office which was holding your unclaimed property and apply for it. For those who were unaware of the list, business services popped up all over the place asking for finders fees. They would give you information about the fact that you have unclaimed property being held somewhere. Then they would charge a finders fee to assist you in recovering your unclaimed property.

Government Warning

Beware of people who pretend to be the government and offer to send you unclaimed money for a fee. These scammers use a variety of tricks to get your attention, but their goal is the same: to get you to send them money. Government agencies will not call you about unclaimed money or assets

What is Unclaimed Money?

Unclaimed money can come from banks, credit unions, pensions, and other sources which have been turned over to the government as unclaimed. The government’s job is to find the owner of the unclaimed money, by making this information public knowledge. If the government owes you money and you do not collect it, then it’s unclaimed.

I have shared information on unclaimed money with many different people, leading them to find unclaimed money they were unaware of. I have not been so fortunate, but have seen my father, 2 sisters, and a few cousins names on the list.

Where Do I Look for Unclaimed Money?

State Search

You should search in every state where you have lived. Start with your state’s listing of unclaimed funds and property. You can conduct a free multi-state search by going directly to Missing Money, the NAUPA-sponsored search engine, or search state-by-state on individual unclaimed property programs by clicking the appropriate jurisdiction on the map or dropbox below.

Unclaimed Back Wages

Unpaid Wages – If you think you may be owed back wages from your employer, search the Wage and Hour Division’s (WHD’s) database of workers for whom it has money waiting to be claimed. WHD (Wage and Hour Division ) is a part of the U.S. Department of Labor (DOL). You search by the employer’s name.

Life Insurance

Search the U.S. Department of Veterans Affairs (VA) for unclaimed insurance funds that are owed to certain current or former policyholders or their beneficiaries.

Note: This does not include funds from Servicemembers’ Group Life Insurance (SGLI) or Veterans’ Group Life Insurance (VGLI) policies from 1965 to the present.

Unclaimed Retirement Money

The Pension Benefit Guaranty Corporation (PBGC)a US Government agency, protects the retirement incomes of more than 37 million American workers in private-sector defined benefit pension plans. A defined benefit plan provides a specified monthly benefit at retirement, often based on a combination of salary and years of service.

You can use their online database to search for unclaimed pension money from former Employers companies that went out, of business or ended a defined plan.

Bank Failures

Bank Failures – Search the Federal Deposit Insurance Corporation (FDIC) for unclaimed funds from failed financial institutions.

Credit Union Failures

Credit Union Failures – Find unclaimed deposits from credit unions. When a credit union with federal insurance is liquidated, the NCUA’s Asset Management and Assistance Center is responsible for paying the share accounts to the members.

On rare occasions, the liquidation of a credit union may result in surplus funds. If a surplus remains, a distribution to the shareholders is required. This may occur several years after the credit union is liquidated and it is sometimes difficult to locate these members. The claim list is in pdf format.

Mortgages

FHA-Insurance Refunds – If you had an FHA-insured mortgage, you may be eligible for a refund from the U.S. Department of Housing and Urban Development (HUD).

To search the HUD database, you will need your FHA case number (three digits, a dash, and the next six digits—for example, 051-456789).

Tax Refund

The Internal Revenue Service(IRS) may owe you money if your refund was unclaimed or undelivered.

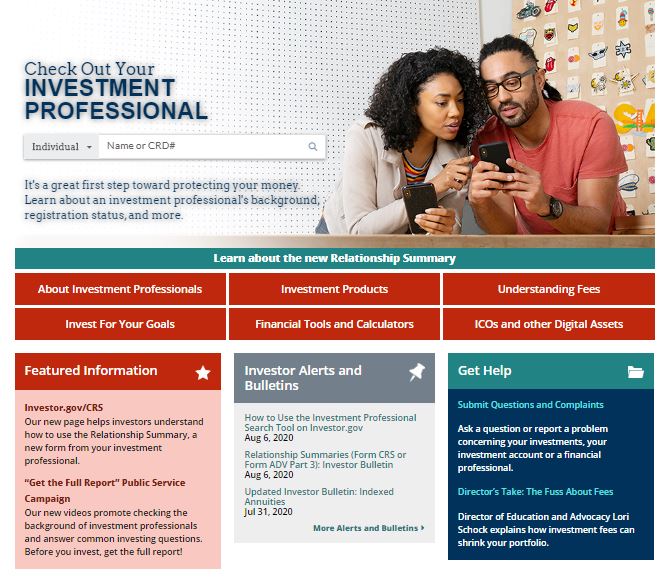

Money Owed Investors

SEC Claims Funds – The Securities and Exchange Commission (SEC) lists enforcement cases where a company or person owes investors money.

Damaged Money

Damaged Money – The Treasury Department will exchange mutilated or damaged U.S. currency.